As per the guidelines from the Ministry of MSME, all MSMEs are required to be registered on Udyam

What is RXIL?

The Gateway To Financial Growth For MSMEs

Receivables Exchange of India Limited (RXIL), is a TReDS platform that supplies working capital to MSMEs, promoting economic development. From invoice discounting to factoring, it bridges the gap between buyers, sellers, and financiers in a seamless process. Set up by the Small Industries Development Bank of India (SIDBI) & National Stock Exchange of India Limited (NSE) in December 2014, RXIL continues to lead the MSMEs to growth in India.

WHAT IS TREDS?

The Platform For MSMEs To

Unlock Capital

TReDS is an online digital platform set up to facilitate MSMEs to unlock working capital by converting their receivables into cash. TReDS gives capital access to the credit-starved small businesses in India.

WHAT IS RXIL GLOBAL?

The Platform Simplifying Cross Border Trade Financing

RXIL Global IFSC Limited, a subsidiary of Receivables Exchange of India Limited (RXIL), ITFS (International Trade Financing Service) Platform is poised to become an integrated provider of financing opportunities par excellence. It is benchmarked with global best practices for supporting the growth and development of Indian and global enterprises in unleashing their full potential towards global trade and commerce under the envision of IFSCA.

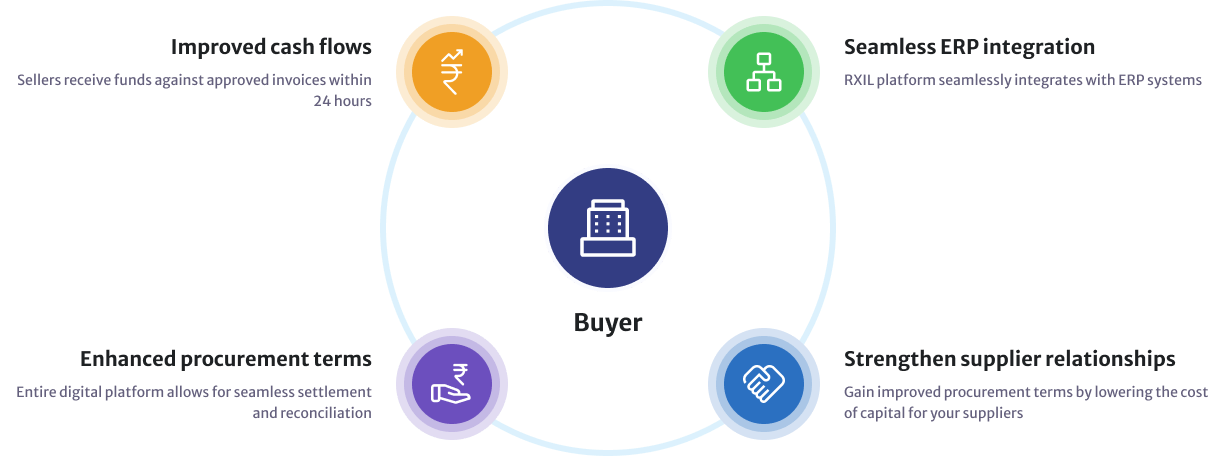

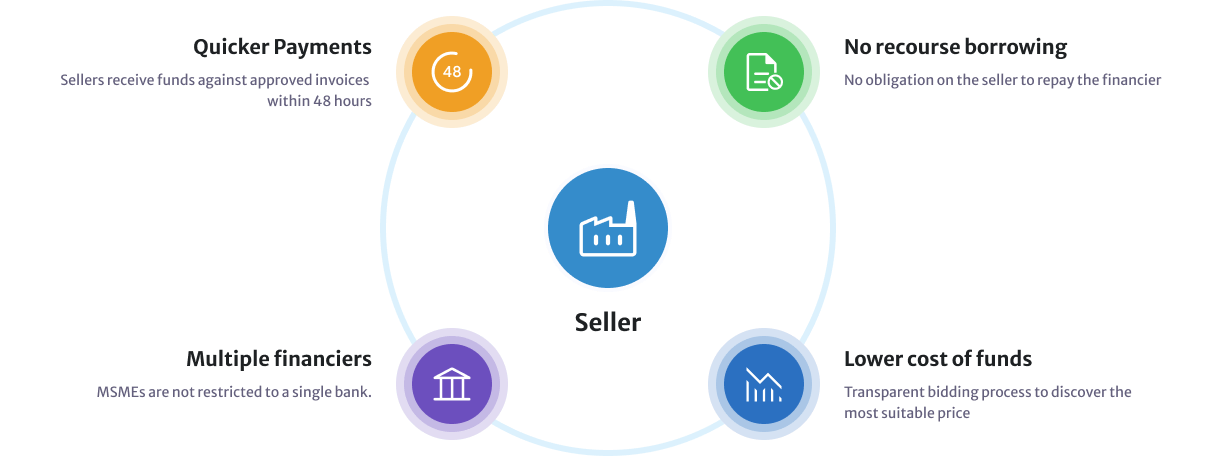

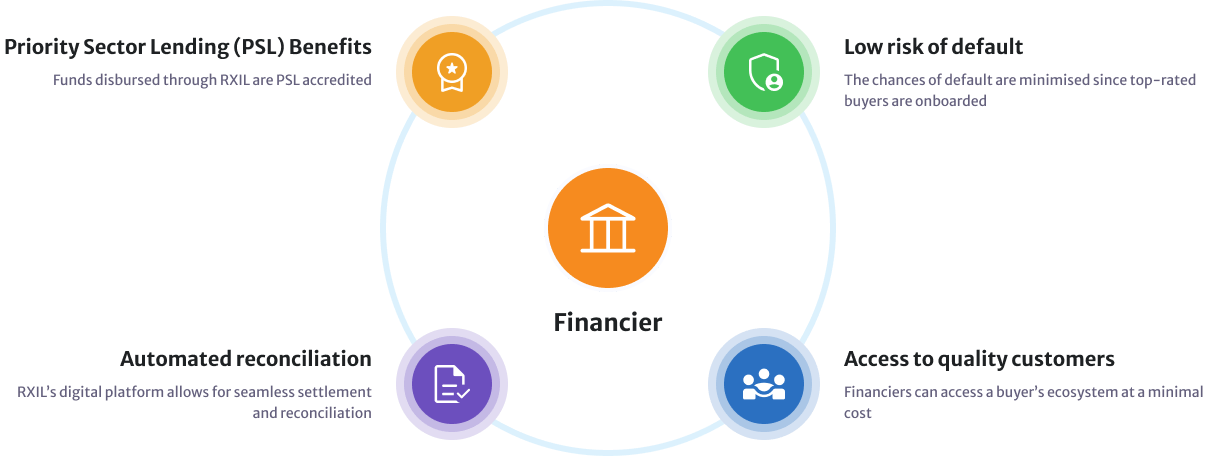

WHat are The advantages of Rxil?

The Services Benefitting The Entire Value chain

Who are the rxil shareholders?

What Do The reviews say?

The Testimonials by Our Users

“We get the bids from various banks who are registered on the platform, and we accept the lowest bids thereby reducing our cost and we pass the same cost to the customers and the main thing is that the MSME suppliers get enough money to turn around their business and give us enough goods on time for our projects. This is the key to our success. I thank RXIL and government of India to introduce such a great platform”.

Manoj Goel

Director - RS Infraprojects Pvt Ltd

“We were in the process where it used to take 60-90 days to receive our money from the buyers but because of RXIL platform and scheme we started receiving the funds within 2-3 days the time buyer puts it on auction”.

Sandeep S Tamhankar

Managing Director United Telecom Ventures

“With the help of RXIL where they facilitate the funds, we are happy that there is an immediate sale of Invoice happening in the platform”.

Chacko Mathew

Director Marketing - Sunvoice Electronics Pvt Ltd

“I am getting the payment through RXIL in 10 days max and the platform gives time to buyers to settle the payment in 60 days. The best part is that we need not go anywhere for signing purpose as the platform is completely digital. We thank RXIL for this easy platform”.

Deepika Setia

CEO - Victor Component Group

“It was a nightmare in terms of vendor payments for us. RXIL is a very good platform and is very easy to deal with our MSME vendors. It is a one stop solution for MSME vendor payments.”

Jitendra Mehta

Finance Manager

Where are we present?

The Latest News, Events and Blogs

Collateral-Free Loans for MSMEs: Why Bill Discounting Might Be a Smarter Option

RXIL Team | 2-4-2026 01:21 PMRead more

Union Budget 2026: Strengthening MSMEs through Equity Capital and TReDS Reform

RXIL Team | 2-4-2026 01:19 PMRead more

The Union Budget 2026 has brought significant reforms to empower MSMEs

RXIL Team | 2-4-2026 12:49 PMRead more

Receivables Exchange of India Ltd declares maiden dividend of 21.6%

RXIL Team | 1-31-2026 04:19 PMRead more