About TReDS

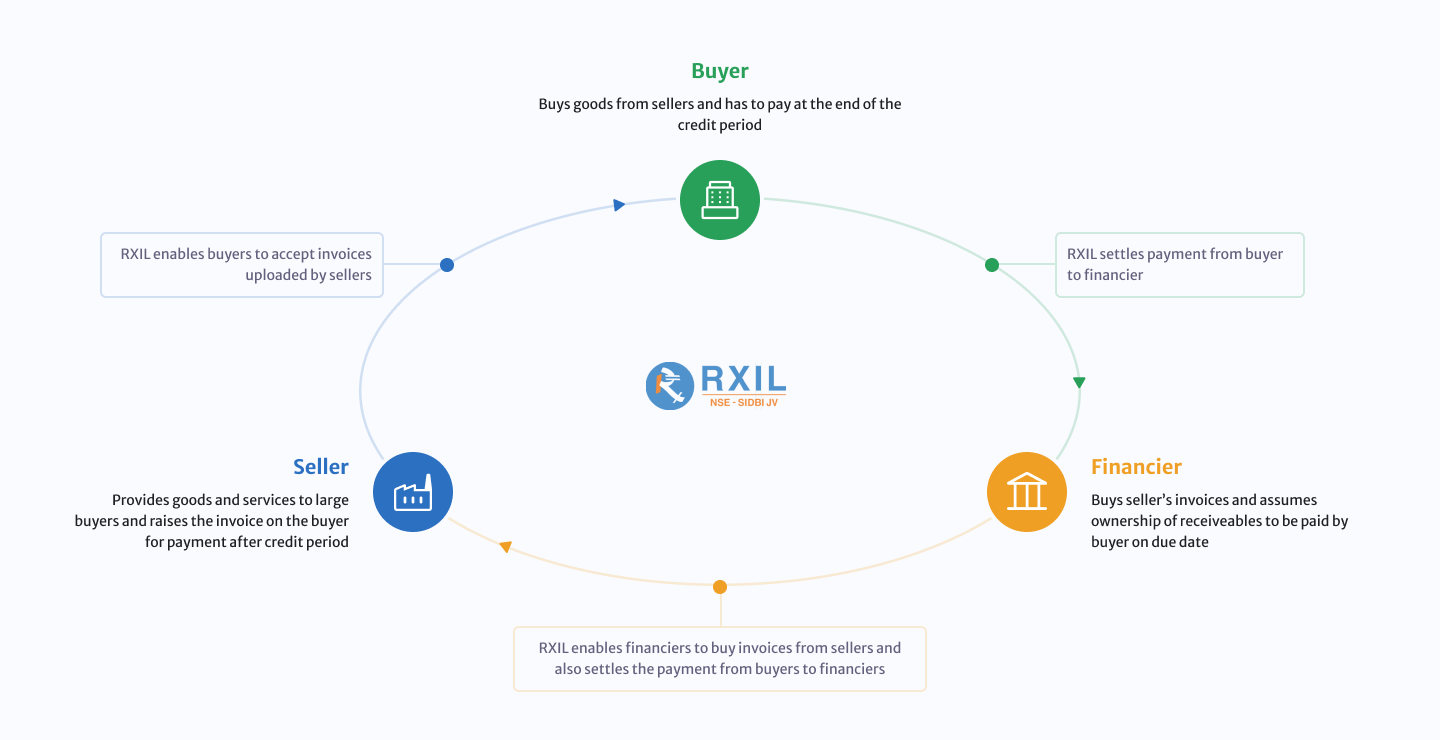

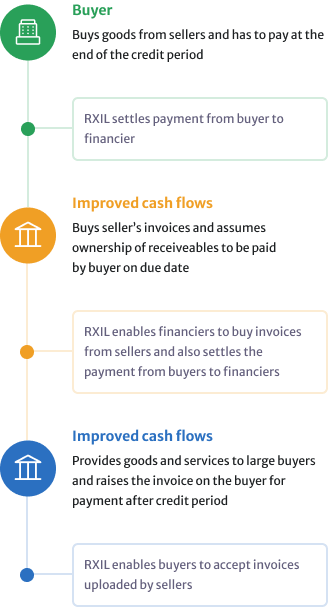

Trade Receivables Discounting System (TReDS) is an online platform set up to facilitate MSMEs to unlock working capital by converting their receivables into cash. TReDS gives capital access to the credit-starved small businesses in India.

WHY TReDS?

The Innovative Platform

Facilitating Financial Security

- Unified platform for sellers, buyers, and financiers

- Complete paperless process

- Easy and quick access to all the funds

- End-to-end digital platform and payments

- Competitive discount rates through an auction mechanism

- Seamless data flow between participants and the platform

- Standardized and regulated practices

Who can register on TREDS?

The 3 Facets That Keep TReDS Running

MSMEs engaged for at least 1 year since its date of registration in following categories can register on TReDS.

HOW TO REGISTER ON TREDS

The Seamless Digital Onboarding And Registration Process

01 Registration

01 Online registration

02 Letter of Authorisation/Board Resolution/Declaration

03 Master agreement and general terms and conditions

02 Entity KYC

01 PAN card

02 Address proof

03 CoI, CA, MSME Cetificate

04 MOA and AoA

03 KYC Individuals

01 Identity proof, Signature verification from banker

02 Address proof

04 Statutory and Financials

01 Annual report (2 years), ITR, Account statement

02 Shareholding pattern

03 GST registration number, Udyog Aadhaar, NoA

05 Bank Details

01 Bank mandate

02 Cancelled cheque leaf