Every MSME knows that growth isn’t just about big orders or new opportunities. It’s about having enough liquidity to keep the wheels turning. You need money flowing in the system at all times to handle day-to-day expenses, pay vendors, keep production moving, and avoid last-minute cash crunches. That’s where the sources of working capital come into play.

Think of working capital as the fuel that keeps an MSMEs engine running smoothly. When it’s available, the business moves with confidence. When it isn’t, even profitable companies feel stuck. And for many MSMEs, the real challenge isn’t lack of orders but money locked inside unpaid invoices. In India, over 80% of MSMEs face delayed payments, and buyers often take 45–90 days longer than agreed terms, according to MSME Ministry reports. This delay traps nearly ₹10.7 lakh crore annually in receivables, capital MSMEs urgently need for survival.

That’s why this guide doesn’t just explain what working capital is or why it matters. It also explores the different ways MSMEs can generate it, through internal resources, external financing, and increasingly through bill discounting, a faster route that turns approved invoices into immediate liquidity.

What is Working Capital?

Working capital is the difference between your current assets and current liabilities. It’s the money your business uses to manage day-to-day operations and meet short-term needs. When managed well, it ensures you can meet payments, handle day-to-day expenses, and maintain an uninterrupted cash flow without relying on emergency borrowing. Strong working capital management ultimately reflects how smoothly your business can run.

Why Working Capital Is Essential for MSMEs?

Walk through any MSME cluster, whether it’s a textile unit in Surat or an engineering shop in Coimbatore, and you’ll see the same pattern. Payments from customers take time, but expenses do not wait. Employees expect salaries, suppliers want timely settlement, and machines don’t run on promises.

For MSMEs, working capital isn’t just money. It is continuity.

- Working capital helps in keeping production cycles running without delays

- Helps in improving financial stability during seasonal fluctuations

- Allows to strengthen vendor relationships

- It affects the interest rates you receive on loans

- It ensures you can meet short-term obligations confidently

Without working capital, the entire business starts to slow down. With the working capital, the MSME ecosystem flourishes.

Delayed receivables and recurring liquidity gaps remain the biggest operational challenges for MSMEs, with TReDS emerging as a proven solution for transparent, fast, collateral-free invoice financing.

What are the different sources of working capital?

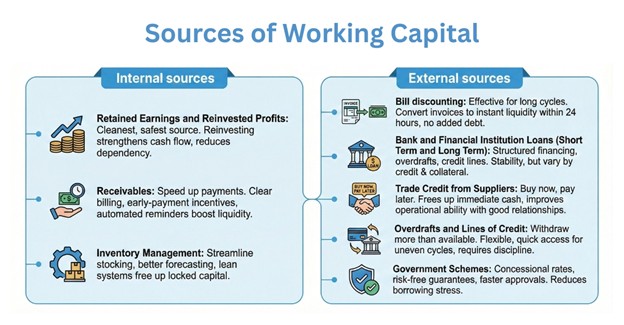

MSMEs can tap into two broad sources of working capital, internal and external. Each option has its strengths and should be chosen based on your business cycle, repayment capacity and urgency.

Internal sources

- Retained Earnings and Reinvested Profits

This is the cleanest and safest source of working capital. Instead of withdrawing all profits, reinvesting them strengthens cash flow and reduces dependency on lenders. MSMEs that consistently reinvest are better equipped to handle expansion and unpredictable costs. - Receivables

Speeding up customer payments instantly boosts your working capital availability. Clear billing cycles, early-payment incentives and automated reminders can reduce credit days and help your business maintain liquidity. - Inventory Management

Excess or slow-moving inventory silently blocks funds. Streamlined stocking, better forecasting and lean inventory systems free up capital that would otherwise stay locked, improving the overall financial cycle.

External sources

- Bill discounting

Bill discounting is one of the most effective sources of working capital, especially for MSMEs dealing with long payment cycles. Instead of waiting 30 – 90 days for clients to pay, you convert invoices into instant liquidity within 24 hours. It strengthens cash flow without adding debt to your balance sheet. - Bank and Financial Institution Loans (Short Term and Long Term)

Traditional lenders offer structured financing, overdraft facilities and credit lines. While they provide stability, approval timelines and interest rates can vary depending on credit history and collateral. - Trade Credit from Suppliers

Trade credit helps MSMEs buy raw materials or goods now and pay later. It’s a powerful tool when managed well because it frees up immediate cash and improves your ability to meet operational needs. Good supplier relationships make this option even stronger. - Overdrafts and Lines of Credit

Banks allow businesses to withdraw more than what’s available in their accounts. Overdrafts offer flexibility and quick access, making them useful during uneven cash cycles, but they need careful discipline due to fluctuating costs. - Government Schemes

Government-backed financing schemes for MSMEs offer concessional interest rates, risk-free guarantees and faster approvals. These options reduce borrowing stress and improve your working capital position.

Choosing the Right Source of Working Capital

As we explore the financial landscape around MSMEs, one pattern becomes clear. Every source of working capital has its purpose, but not every option fits every moment. The real skill lies in recognising what the business needs right now versus what it can afford over time.

Some sources offer stability. Others offer speed. Loans bring structure. Internal reserves bring independence. But each option also comes with conditions: repayment cycles, documentation, collateral and the unavoidable impact of interest rates.

So, the decision becomes a balancing act.

- How quickly do you need liquidity?

- Can the business carry additional debt?

- Is your customer payment cycle predictable enough to wait?

- Or do cash gaps keep returning despite all planning?

As the narration follows real MSMEs through their day-to-day challenges, a familiar story emerges. Most delays, most production slowdowns, most missed opportunities trace back to the same issue, cash trapped in pending invoices.

And when that’s the bottleneck, traditional options often fall short. Internal funds aren’t always enough. Bank processes take time. Supplier support has limits. Yet the business still needs an immediate way to meet short-term obligations and maintain steady cash flow.

This is where the journey shifts. Because once you see how much working capital is locked inside approved but unpaid invoices, the next solution becomes almost inevitable i.e. invoice discounting.

Invoice Discounting: The Most Effective Source of Working Capital for MSMEs

Among all sources of working capital, invoice discounting stands out. Here’s why.

MSMEs usually face a gap between delivering products and receiving payments. This gap can be 30, 60 or even 120 days. During that period, you still have salaries to pay, raw materials to purchase and short-term obligations to manage. Invoice discounting bridges that gap instantly.

You simply submit your approved invoices, and a financial platform offers upfront cash, within 24 hours. When the customer pays, the lender deducts a small fee and releases the balance.

What makes this powerful:

- This boosts cash flow immediately

- It doesn’t increase debt on your books

- It helps you meet short-term needs without stress

- It supports continuous production and timely delivery

- It protects your credibility with vendors and employees

- It eliminates dependency on slow-paying customers

For MSMEs dealing with recurring working capital shortages, invoice discounting provides predictable liquidity, cleaner financial cycles and the confidence to accept larger orders.

RXIL: Transforming MSME Liquidity Through RBI-Regulated Invoice Discounting

RXIL, India’s first RBI-regulated TReDS platform, is reshaping the way MSMEs access liquidity. By bringing Financiers (banks and NBFCs), and corporate buyers onto one transparent bidding ecosystem, RXIL enables MSMEs to unlock funds against approved invoices within 24 hours. The entire process is digital, collateral-free, and built to ease the chronic cash-flow pressures seen across MSME clusters. For thousands of businesses, this shift has meant fewer delays, stronger vendor relationships, and the confidence to take on larger orders without waiting for payments to clear.

1. Secure, Credible & RBI-Regulated

A joint venture of SIDBI and NSE along with ICICI, YES Bank and SBI, RXIL TReDS operates under RBI regulations and offers safe, secured and compliant environment for MSMEs to finance their invoices.

2. Over ₹2 Lakh Crore Financed

RXIL has crossed ₹2 lakh crore in invoice financing, reflecting the platform’s reliability, the strength of its network, and the confidence MSMEs, corporates, and financiers place in it nationwide.

3. Strong Ecosystem for Better Opportunities

MSMEs benefit from a strong network of 70+ financiers, 3,000+ corporates and PSUs, leading to competitive bids, faster invoice validation, and improved chances of getting funded quickly.

4. Faster Access to Working Capital

RXIL, an RBI-regulated TReDS platform, helps MSMEs get access to working capital within 24 hours through competitive bidding on approved invoices from multiple financiers, without waiting for long corporate payments cycles.

5. 100% Digital, Transparent & No-Collateral Process

On RXIL TReDS, MSMEs simply upload their invoices and the corporates approve them. Once approved, banks and NBFCs bid on these invoices allowing MSME to access the funds within 24 hours without any collateral, paperwork, or loan-based liabilities. The entire workflow is digital and transparent, so funds move quickly without adding debt to the balance sheet or creating administrative hassle.

6. Better Cash-Flow Planning & Business Stability

MSMEs can operate, maintain inventory, pay salaries, and make expansion investments more confidently.

Conclusion

At the end of the day, a business grows not just because of demand, but because it has the liquidity to keep moving. Understanding your sources of working capital, internal and external, gives you the freedom to manage costs, expand operations and navigate market uncertainties without losing momentum.

Whether you rely on reinvested profits, trade credit, loans or invoice discounting, the goal is simple: maintain strong cash flow, stay flexible and protect your financial health. And for many MSMEs today, invoice discounting has become the smartest, fastest and most reliable path to ensuring uninterrupted working capital throughout the year.

FAQs

- What is working capital, and why is it important for MSMEs?

Working capital is the difference between current assets and current liabilities. MSMEs need it to manage day-to-day operations, pay suppliers, handle short-term obligations and maintain steady cash flow. Without adequate working capital, production slows, opportunities are missed and financial stability becomes harder to maintain. - What are the main sources of working capital available to MSMEs?

While MSMEs have various internal and external working capital sources, such as bank loans, overdrafts, trade credit, government schemes, and equity funding, bill discounting on RBI-regulated TReDS platforms has emerged as one of the most efficient and transparent options. It enables MSMEs to unlock cash within 24 hours from their approved invoices, access competitive bids from multiple financiers, and improve liquidity without adding debt to their books. - Can MSMEs use their invoices to get working capital?

Yes, MSMEs can convert approved invoices into immediate cash through invoice discounting. Instead of waiting 30–90 days for buyers to pay, invoice discounting unlocks liquidity within 24 hours, helping businesses manage expenses, maintain production and avoid delays caused by slow customer payments. - What factors should MSMEs consider before choosing a source of working capital?

MSMEs should evaluate speed of access to funds, cost of capital, interest rates, repayment term, collateral requirements, cash flow needs, customer payment cycles and whether the source adds debt. The right choice depends on urgency, financial stability and the specific business environment. Among the available choices, RBI-regulated TReDS platforms like RXIL offer a strong advantage by providing funds within 24 hours, collateral-free access to working capital without increasing liabilities. Financing is based on approved invoices through a transparent, fully digital system, making it one of the most efficient and MSME-friendly ways to manage liquidity. - When should an MSME use trade credit vs bank loan vs invoice discounting?

Trade credit works when suppliers trust you and allow deferred payments. Bank loans suit planned needs but involve paperwork and repayment commitments. Invoice discounting is ideal when cash is tied in receivables and the business needs fast, debt-free working capital to keep operations smooth. - Can I get money from an invoice immediately after issuing it?

Through invoice discounting via TReDS, MSMEs can receive funds within 24 hours. All they have to do is upload the invoice, which is then approved by the corporate. Post approval on the invoice, banks and NBFCs bid on it. Finally, the MSME selects the suitable bid, turning a pending invoice into working capital without waiting for the corporate’s payment cycle.