When you run a business, the toughest days often come not because you lack orders, but because you’re waiting on payments. Money gets trapped in unpaid invoices, and even a profitable company can feel cash-starved. That gap affects everything, from buying raw material to paying vendors, handling salaries, and chasing new opportunities. This is exactly where invoice factoring comes in to help businesses. It gives you immediate liquidity by unlocking money that already belongs to you. Instead of waiting for clients to clear dues, you turn invoices into cash and keep your business moving.

What is Invoice Factoring?

Invoice factoring is a financing method where businesses sell their accounts receivable (outstanding invoices) to an invoice factoring company at some agreed discount. The company handling the invoices takes over the responsibility for collecting payment, while you receive most of the invoice value upfront. It’s not a loan. You’re not adding a liability; you’re simply speeding up your cash flow. This makes factoring a practical option for MSMEs that constantly face delays in payment terms of 30, 60, or 90 days.

How Does Invoice Factoring Work?

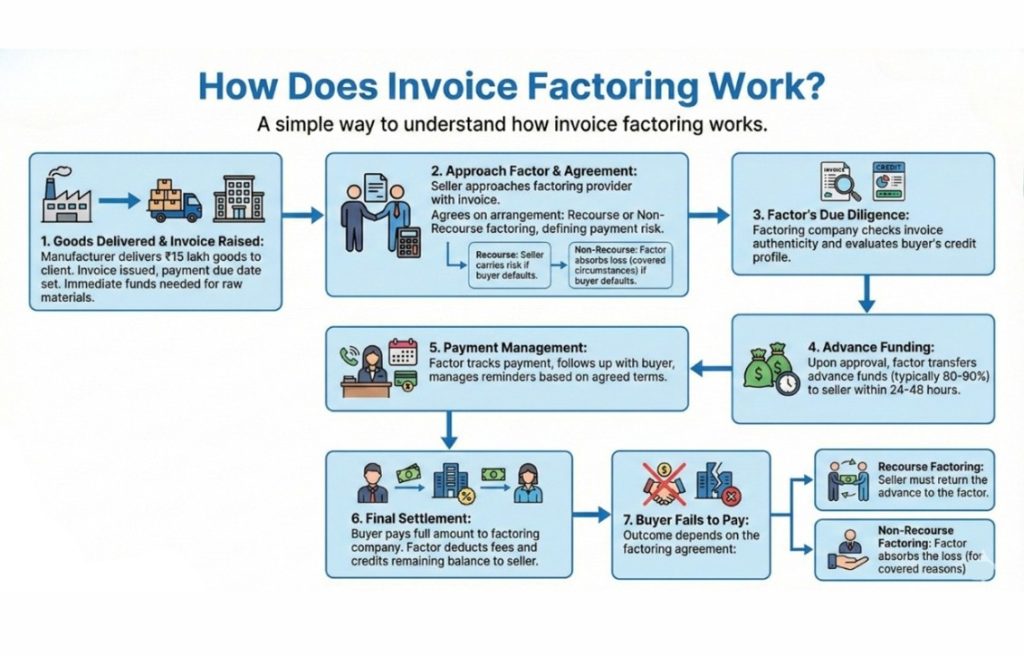

A simple way to understand how invoice factoring works.

Your manufacturing unit has delivered goods worth ₹15 lakh to a client. The buyer will pay on the due date, but you need funds right now to purchase new raw materials. You approach a factoring provider and submit the invoice along with an agreed factoring arrangement: recourse or non-recourse, so that everyone is clear on who carries the risk if the buyer doesn’t pay.

The factoring company checks the authenticity of the bill and evaluates your buyer’s credit profile. After approval, the factoring company sends the fund transfer within 24-48 hours. The factor tracks the payment, follows up with the buyer, and manages reminders based on the invoice terms (recourse or non-recourse). When the customer pays to the factoring company, the remaining amount is credited to the sellers after deducting the agreed-upon factoring fees.

If a customer fails to pay, what happens next depends on the type of factoring agreement you chose.

- In recourse factoring, you must return the advance.

- In non-recourse factoring, the factor absorbs the loss if the buyer is unable to pay under covered circumstances.

Different Types of Invoice Factoring

- Recourse factoring: This is the most commonly used type. If the buyer doesn’t pay, the business must return the advance received. Since the risk stays partly with you, fees remain low, and approvals are fast.

- Non-recourse factoring: Here, the risk shifts to the factor. If the buyer becomes insolvent or is unable to clear dues under covered circumstances, the factoring company absorbs the loss. This protection comes at a slightly higher cost.

- Spot factoring: This is when a business sells a single invoice or a select few invoices on an as-needed basis, offering more flexibility than factoring the entire ledger.

- Whole ledger factoring: Also known as whole turnover factoring, this type involves selling all of a business’s outstanding invoices to the factoring company.

- Full-service factoring: In this arrangement, the factoring company takes care of all credit management, collections, and sales ledger management in addition to providing funding.

Who Can Benefit from Invoice Factoring?

Invoice factoring works best for businesses that live with constant payment delays. If your cash flow tightens every time customers take too long to clear dues, this is where factoring steps in.

Industries that often use factoring include:

- Manufacturing

- Logistics

- Wholesale and distribution

- Staffing services

- IT and consulting firms

Companies with seasonal revenue cycles or businesses growing faster than their cash reserves also rely on invoice factoring to stay steady. If your clients are reputable but slow-paying, factoring can be a lifesaver.

Pros of Invoice Factoring

The most significant benefit is that it will improve cash flow without incurring more debt. You get access to capital right away and do not have to stop your operations.

Invoice factoring has other benefits, which include:

- An invoice is only required as security.

- Quick access to funds (24 to 48 hours) compared to regular business loans.

- Less workload as the factor handles follow-ups.

- The cash cycles are predictable even when the buyers take a long time to pay.

- Improved supplier relationship since you are able to pay on time.

When your working capital is stable, it is easy to negotiate early-payment discounts, take larger orders, and even plan to grow.

Cons of Invoice Factoring

Like any financial solution, invoice factoring comes with its own set of limitations. It works well for many MSMEs, but there are a few considerations you should keep in mind so you know exactly what you’re signing up for.

- You receive a smaller payout.

- In a recourse factoring setup, you must repay the advance if the customer fails to pay.

- Since the factor manages collections, they may contact your corporates, which means you need to maintain clear communication so relationships remain smooth.

- Factors prefer customers with strong credit profiles, so not every invoice may qualify.

All these disadvantages don’t take away the value of factoring, but they do remind MSMEs to choose the solution that truly fits their situation. And when these limitations feel restrictive, bill discounting on RBI-regulated TReDS platforms becomes a strong alternative. Multiple banks and NBFCs bid on each approved invoice, often offering a higher payout at competitive rates. This makes TReDS one of the most transparent and reliable ways to turn verified invoices into fast working capital.

Bill Discounting through TReDS: A Great Alternative to Invoice Factoring

RBI has introduced Trade Receivables Discounting System (TReDS) to address one of the biggest challenges faced by the MSMEs, delayed payments from corporates. This platform is digitally regulated, where MSMEs can get their approved invoice financed at competitive bids by banks and NBFCs. Through complete transparency, quicker payments, and standardised processes, TReDS assists MSMEs in unlocking their working capital without incurring debt. A platform operated under strict RBI guidelines, TReDS brings MSMEs, corporates, PSUs, and financiers together on one ecosystem, making cash flow more predictable and eliminating dependence on the traditional loan system.

TReDS is one of the strongest alternatives for MSMEs, especially those working with large corporates or PSUs. Through platforms like RXIL, MSMEs can access working capital by simply uploading their invoices. Once the corporate validates the invoice, multiple banks and NBFCs place competitive bids, allowing the MSME to choose the best rate and receive funds, within 24 hours.

RBI has introduced Trade Receivables Discounting System (TReDS) to address one of the biggest challenges faced by the MSMEs, delayed payments from corporates. This platform is digitally regulated, where MSMEs can get their approved invoice financed at competitive bids by banks and NBFCs. Through complete transparency, quicker payments, and standardised processes, TReDS assists MSMEs in unlocking their working capital without incurring debt. A platform operated under strict RBI guidelines, TReDS brings MSMEs, corporates, PSUs, and financiers together on one ecosystem, making cash flow more predictable and eliminating dependence on the traditional loan system.

TReDS is one of the strongest alternatives for MSMEs, especially those working with large corporates or PSUs. Through platforms like RXIL, MSMEs can access working capital by simply uploading their invoices. Once the corporate validates the invoice, multiple banks and NBFCs place competitive bids, allowing the MSME to choose the best rate and receive funds, within 24 hours.

Invoice factoring vs. Bill Discounting

| Point of Difference | Invoice Factoring | Bill Discounting (via TReDS) |

| Basic Idea | You sell your invoice to a factor and receive most of the amount upfront. | You get funds by discounting an approved invoice or bill with a bank or financier. |

| Speed | Fast, but depends on the factor’s internal checks. | Extremely fast on TReDS funding happens within 24 hours through competitive bidding. |

| Collections | The factoring company takes over the responsibility for collecting payment from the buyers. | The bank/financier is repaid when the corporate pays on the due date. Collections usually do not involve the MSME. |

| Ownership of Invoice | Invoice ownership is transferred to the factoring company. | Invoice ownership remains with the MSME; only the payment right is assigned. |

| Visibility to Corporate | Usually disclosed. Corporates know the invoice has been factored. | In TReDS bill discounting, corporates always know since they approve the invoice on the platform. |

| Pricing | Fees depend on risk, tenure, and the type of factoring (recourse/non-recourse). | Rates are more competitive on TReDS due to bidding by multiple banks/NBFCs. |

| Risk | In recourse factoring, MSME carries the risk. In non-recourse factoring, the factor covers credit risk. | The MSME has zero risk. |

| Best For | Any MSMEs want liquidity plus relief from collection stress. | MSMEs working with large corporates or PSUs that want quick, low-cost financing. |

| Regulatory Setup | Largely unregulated | On TReDS (like RXIL), fully RBI-regulated, ensuring transparency and security. |

| Payment | Typically, 70–90% upfront; balance post customer payment. | MSME gets paid fully after deduction of the discount value within 24 hours. The corporate pays the face value of the bill on the due date. |

How to Choose the Right Bill Discounting Platform

Selecting an appropriate bill discounting platform makes all the difference for MSMEs. The ideal partner must provide transparency, speed, and a fully digital experience. RXIL brings these strengths together, making it a reliable and efficient choice for businesses seeking quick access to working capital.

100% Digital Onboarding Process

RXIL offers a fully online onboarding process with clear, transparent steps and zero paperwork. Since the platform operates under RBI regulation, MSMEs join a trusted, compliant system that keeps everything secure and simple.

Backed by SIDBI & NSE (Strong Compliance & Trust)

A joint venture of SIDBI and NSE along with ICICI, SBI and Yes Bank, RXIL operates under the RBI-regulated TReDS framework, ensuring complete transparency, security, and governance. This backing gives MSMEs confidence that every transaction is safe and fully compliant.

Trusted by MSMEs Across India

RXIL is India’s leading TReDS platform, trusted by over 51,500 MSMEs across 1,160+ cities. This wide adoption reflects its reliability, efficiency, and strong track record in enabling smooth cash-flow access.

Access to 70+ Financiers (Banks & NBFCs)

MSMEs do have the advantage of competitive bidding of all invoices since RXIL has 70+ active financiers (banks & NBFCs), which ensures they get better discounted rates and faster liquidity.

Supported by 3,000+ Large Corporations & PSUs

RXIL is integrated with 3,000+ corporates and PSUs, giving MSMEs broad access to corporates across industries, strengthening financing opportunities and enabling faster payments.

Conclusion

Invoice factoring solves a simple but critical problem, which is delayed payments. It frees up cash stuck in invoices so MSMEs can focus on growth, not follow-ups. With faster access to working capital, predictable collections, and relief from the stress of payment cycles, factoring becomes more than a financial tool; it becomes a strategic advantage.

But as MSMEs scale and the volume of receivables grows, many discover they need a more transparent, regulated, and competitive system to unlock liquidity. That’s where bill discounting on the RBI-regulated TReDS platform comes in. On RXIL, approved invoices attract bids from multiple financiers such as various banks and NBFCs, letting MSMEs secure & faster payments (within 24 hours) that too without any collateral. It’s the next step for businesses looking to move from stop gap cash solutions to a structured, long-term working capital.

FAQs

- Is invoice factoring worth it?

Yes, if you are any MSME that works with corporates and struggles with delayed client payments. It unlocks immediate cash, strengthens cash flow, and saves time on collections, making operations smoother and more predictable. - How quickly can I get payment through invoice factoring?

Most factoring companies release funds within 24-48 hours after verification. On RBI-regulated TReDS platforms, MSMEs receive payments within 24 hours as banks and NBFCs bid in real-time. - Are there any alternatives to invoice factoring?

Yes, bill discounting on TReDS is the strongest alternative. MSMEs can access working capital within 24 hours on their approved invoices, benefit from competitive bids from multiple financiers, without creating additional debt on their books. - Is invoice factoring considered a loan?

No, invoice factoring is not a loan as you are selling your receivable for faster payment. It doesn’t add liabilities to your balance sheet, unlike loans, and approval relies mainly on your buyer’s creditworthiness. - What are the best factoring companies in India?

Although several factoring companies operate in India, bill discounting on TReDS platforms regulated by the RBI is one of the most preferred options for MSMEs. Among these, RXIL stands out as a leading and trusted name. A joint venture of SIDBI and NSE, RXIL provides a fully digital, secure way for MSMEs to access working capital within 24 hours. With 51,500+ MSMEs from 1,160+ cities, 3,000+ large corporates and PSUs, and 70+ financiers, including banks and NBFCs, RXIL has become the preferred bill discounting platform for businesses seeking faster, more reliable liquidity.